Kiwi Saver Gift Card

Information about Kiwi Saver Gift Card including gift card details, card balance check, merchant info, user reviews, phone call, terms and policies.

Website

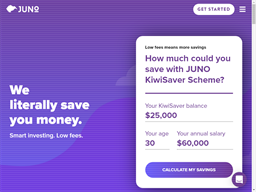

JUNO KiwiSaver Scheme - Lower fees and active managementThe JUNO KiwiSaver Scheme has lower fees, and aims to outperform the market to help grow your KiwiSaver balance. Switch to JUNO today.

Webpages

Website Email

info@junokiwisaver.co.nz

Website About

About

Website Help

HELP ME CHOOSE

Website Contact

Contact

Soical Media

Details

Kiwi Saver

More Information

Pros and cons of credit cards | JUNO

1. Credit cards can tide you over until next pay day. Sometimes the unexpected happens, the car breaks down, or a relative gets sick overseas, and you’re faced with a huge expense, which you can pay instantly on a credit card.

Don't save things for later | JUNO

Notebooks and cards. How often do you send a handwritten note on a monogrammed paper? Food. Enjoy chocolates or boxes of biscuits while they’re fresh. Dried herbs and spices lose their flavour over time too. Books. They go out of date and are rarely re-read. Pass them on. Clothes. If you feel good wearing them, don’t save them for ‘best’.

6 reasons you’re broke, and how to fix it | JUNO

Problem 5: You’re paying interest on credit cards and other personal loans. Paying interest is wasted money. Are you drowning in personal debt? How to fix it: Get a plan in place to reduce your debt, starting with by paying off the debt that has the highest interest. Money Talks is a free budgeting service that can help.

How to work towards financial freedom in your 30s | JUNO

Having high-interest debt, such as credit cards or payday loans, can be stressful. Repaying money month after month can make it really hard to break the cycle of debt, making it really hard to get ahead. We’ve already talked about tackling your student loan.

Why you shouldn’t neglect KiwiSaver when you’re overseas

Glasgow says it’s important to pay off any high-interest debt, like credit cards, before you contribute to your KiwiSaver account. Also, make sure you’re keeping on top of the minimum repayments on your student loan, if you have one, he says.

6 ways to cut down on fuel costs - junokiwisaver.co.nz

Using Fly Buys cards and AA Smartfuel cards at the pump gives you at least 6c a litre off. Add supermarket specials and discounts can be up to 40c a litre. On Gaspy, use the ‘Discounts’ feature to recalculate your cheapest rate based on Fly Buys, supermarket dockets, or other loyalty cards.

Gift Card Info

Gift Card Image

Website Logo

More Information

The money-saving guide for coffee addicts | JUNO

Cafes are starting to introduce prepaid coffee cards, where you purchase 10 coffees up front. ... They're a practical gift that will save you money.

50s and retirement saving | JUNO

Jul 23, 2019 ... Make sure credit cards are fully paid at month-end, ... consider whether it'll be a gift, a loan, or if you'll become a guarantor, ...

Gift Card Balance

Popular Questions

All Articles - JUNO KiwiSaver Scheme

What's the average student loan balance? christmas ... Homemade Christmas

gifts that aren't tacky. power bill.jpg ... Pros and cons of credit cards. get out of ...

gifts that aren't tacky. power bill.jpg ... Pros and cons of credit cards. get out of ...

5 money-saving hacks from a millennial | JUNO

This one is a no-brainer, but it’s a hard habit to crack. Banks love helping uni students to sign up for credit cards and overdrafts. But interest rates are high, so not paying your balance off in full every month can be a slippery slope to a financial crisis.

The power of compound interest | JUNO

By the end of Year 1, your credit card balance has gone up to $11,995, an extra $1,995 even though you didn’t make any additional purchases. How quickly will this go up? Have a look what happens by the end of Year 5 (again assuming you make no repayments). Although you only borrowed $10,000 using your credit card, by the end of year 5, you owe $24,831.40. Not fair right? What is even more ...

How to grow your KiwiSaver balance on your OE | JUNO

Experts JUNO spoke to recommend paying off any high interest debt first while you’re living overseas. This includes credit cards or expensive hire purchase payments. If you have a student loan, you’ll start paying interest once you move overseas. This means your debt will grow.

KiwiSaver and money in your 50s | JUNO

Fees eat into your hard-earned KiwiSaver money and reduce your balance. Check how much you’re paying in fees using the Sorted KiwiSaver Fund Finder and make sure you’re happy with what you’re paying. 4. See the experts . If you haven’t already, seeing a financial adviser in your 50s (and regularly after that) can put you in a great position to meet your money goals for the retirement ...

KiwiSaver and money in your 40s | JUNO

Fees eat into your hard-earned KiwiSaver money and reduce your balance. Check how much you’re paying in fees using the Sorted KiwiSaver Fund Finder and make sure you’re happy with what you’re paying. 2. Get your protection in place . With hopefully a healthy pot of money building for retirement, you want to try your best to not lose it. Diversify your investments, check your insurance ...

KiwiSaver and money in your 30s | JUNO

Fees eat into your hard-earned KiwiSaver money and reduce your balance. Check how much you’re paying in fees using the Sorted KiwiSaver Fund Finder and make sure you’re happy with what you’re paying. 4. Your first home. If buying a house is one of your goals, put plans in place to get there. If you have a home already, think about how you can pay off the mortgage faster. Maybe it’s ...

11 financial resolutions for the new year | JUNO

Put a plan in place to reduce any bad debt, for example, credit cards or high cost debt such as payday loans. An out-of-control credit card balance could hinder your financial future. 2. Focus on savings. Aim to put away 5-10 per cent of your income into an untouchable savings account.

How much should I put into KiwiSaver? | JUNO

If you have consumer debt, like a credit-card balance or personal loan to pay off, tackle this first before increasing your KiwiSaver contributions. That’s because on consumer debt, you’re likely to be charged an interest rate higher than the rate of return you’d reasonably expect on your KiwiSaver. So reducing your debt is actually a better investment than KiwiSaver. Have an emergency ...

How to get out of debt | JUNO

Debt has become part of everyday life. Many of us start borrowing at university with a student loan, or buy our first car, and then just get used to having overdrafts, credit card balances and personal loans.

KiwiSaver and money in your 20s | JUNO

Fees eat into your hard-earned KiwiSaver money and reduce your balance. Check how much you’re paying in fees using the Sorted KiwiSaver Fund Finder and make sure you’re happy with what you’re paying. 3. Start a savings account. If you don’t have any savings, now’s a good time to start. Having some money in an emergency fund for any unexpected expenses can reduce stress. Aim to build ...